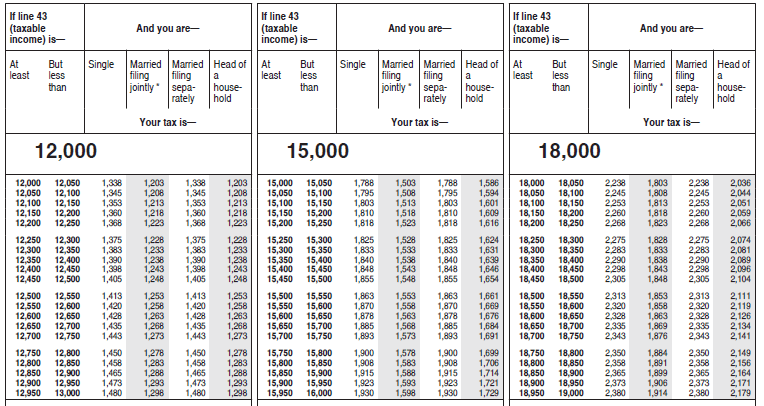

Your child was under age 19 (or under age 24 if a student) at the end of 2022. If you willfully fail to file a return, you may be subject to criminal prosecution. You may have to pay a penalty if you are required to file a return but fail to do so. *** If you didn't live with your spouse at the end of 2022 (or on the date your spouse died) and your gross income was at least $5, you must file a return regardless of your age. But in figuring gross income, don't reduce your income by any losses, including any loss on Schedule C, line 7 or Schedule F, line 9. Gross income from a business means, for example, the amount on Schedule C, line 7 or Schedule F, line 9. Gross income includes gains, but not losses, reported on Form 8949 or Schedule D. If (a) or (b) applies, see the Form 10-SR instructions to figure the taxable part of social security benefits you must include in gross income.

#Irs tax tables 2020 tax year plus

Don't include any social security benefits unless (a) you're married filing a separate return and you lived with your spouse at any time during 2022, or (b) one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if married filing jointly). ** Gross income means all income you receive in the form of money, goods, property, and services that isn't exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). If you're preparing a return for someone who died in 2022, see Death of taxpayer, later. (If your spouse died in 2022, see Death of spouse, later. * If you were born before January 2, 1958, you're considered to be 65 or older at the end of 2022. THEN file a return if your gross income was at least. The rules to determine if you are a resident or nonresident alien are discussed in chapter 1 of Pub. If you are a resident alien for the entire year, you must follow the same tax rules that apply to U.S.

#Irs tax tables 2020 tax year how to

How To Get Tax Help explains how to get tax help from the IRS. In addition, this section helps you decide whether you would be better off taking the standard deduction or itemizing your deductions. This section also discusses the standard deduction for taxpayers who are blind or age 65 or older, as well as special rules that limit the standard deduction available to dependents. Standard Deduction gives the rules and dollar amounts for the standard deduction-a benefit for taxpayers who don't itemize their deductions. Other topics include the SSN requirement for dependents, the rules for multiple support agreements, and the rules for divorced or separated parents. It also helps determine your standard deduction and tax rate.ĭependents explains the difference between a qualifying child and a qualifying relative. Filing status is important in determining whether you must file a return and whether you may claim certain deductions and credits. Who Should File helps you decide if you should file a return, even if you aren't required to do so.įiling Status helps you determine which filing status to use. If you have little or no gross income, reading this section will help you decide if you have to file a return. Who Must File explains who must file an income tax return. It answers some basic questions: who must file, who should file, what filing status to use, and the amount of the standard deduction. This publication discusses some tax rules that affect every person who may have to file a federal income tax return.

You can help bring these children home by looking at the photographs and calling 1-800-THE-LOST (1-80) if you recognize a child. Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. The Internal Revenue Service is a proud partner with the National Center for Missing & Exploited Children® (NCMEC).

Also see Social Security Numbers (SSNs) for Dependents, later. See Form W-7, Application for IRS Individual Taxpayer Identification Number. Your spouse may also need an ITIN if your spouse doesn't have and isn't eligible to get an SSN. If you are a nonresident or resident alien and you don't have and aren't eligible to get a social security number (SSN), you must apply for an individual taxpayer identification number (ITIN). Taxpayer identification number for aliens. 501 (such as legislation enacted after we release it) will be posted at IRS.gov/Pub501. Information about any future developments affecting Pub.

0 kommentar(er)

0 kommentar(er)